The Morpheus Consultancy, LLC

Profit vs. Taxes: A Strategic Framework for Every Stage of Your Business

Business owners inevitably confront a fundamental question:

Should I prioritize demonstrating profitability to attract capital, or focus on minimizing taxes to retain cash?

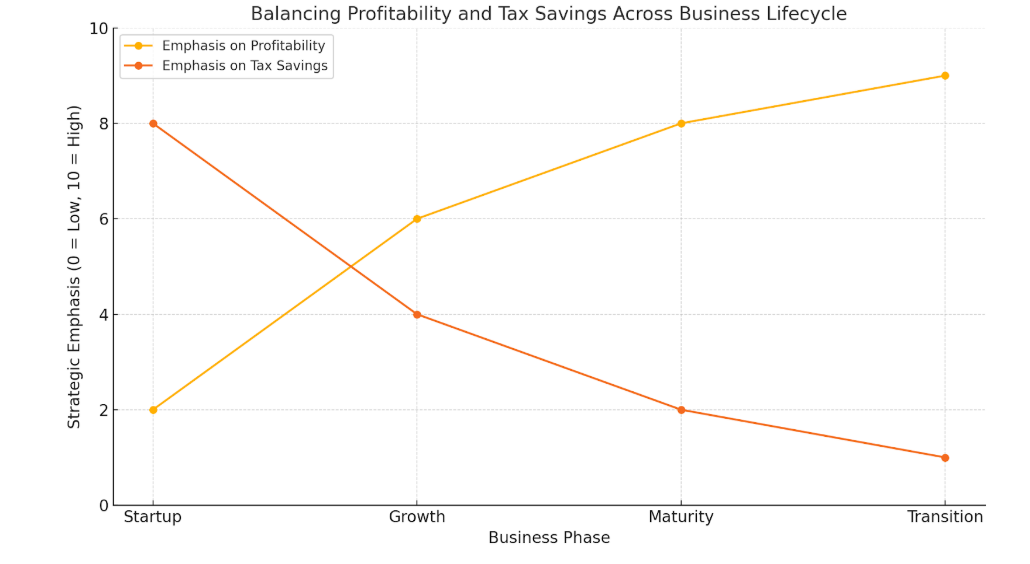

This is not merely a matter of tax planning. Rather, it is a core element of capital strategy, deeply intertwined with a business’s stage of development. The balance between reported profit and tax liability significantly influences access to financing, valuation outcomes, and long-term growth potential, particularly in today’s high-cost, risk-averse economic environment.

Below, we examine this dynamic across the four principal phases of the business lifecycle.

1. Startup Phase: Prioritizing Survival and Foundation-Building

In the startup phase, risk is inherent and profitability is often secondary to establishing viability. The absence of historical financial data typically limits access to traditional forms of capital.

Capital Landscape:

Startups frequently depend on:

1. Personal savings

2. Support from family and friends

3. Angel investors or early equity partners

4. Crowdfunding or grants

Traditional lenders generally regard startups as high-risk, given the lack of collateral and predictable cash flow.

Profit vs. Tax Considerations:

In this phase, tax minimization tends to take precedence. Most startups incur substantial initial investments and operational losses, making it advantageous to:

1. Maximize legitimate deductions (e.g., equipment, marketing, R&D, salaries)

2. Prioritize cash preservation over artificial profitability

Strategic Guidance:

Profitability has limited utility in securing capital at this stage. The priority should be:

1. Refining the business model

2. Articulating a compelling narrative for early-stage investors

3. Managing burn rate prudently

4. Ensuring comprehensive capture of allowable expenses

2. Growth Phase: Leveraging Profitability for Expansion

In the growth phase, demand increases, operations scale, and capital requirements intensify to support hiring, infrastructure, inventory, and technology.

Capital Landscape:

Access broadens to include:

1. Conventional and private lending markets

2. Asset-backed financing or bond issuance

3. Strategic partnerships

Profitability at this stage directly informs market credibility and valuation.

Profit vs. Tax Considerations:

While many businesses in this phase have established tax strategies, it is essential to recalibrate in light of capital and strategic objectives:

1. Debt refinancing generally requires strong profitability metrics

2. Acquisition financing depends heavily on EBITDA and margin performance

3. IPOs or private equity exits necessitate transparent, robust profit records

Strategic Guidance:

Avoid overly aggressive tax strategies that could undermine valuation or erode lender confidence

Leverage tax-efficient mechanisms (e.g., accelerated depreciation, R&D credits) while maintaining a resilient bottom line

Develop forward-looking financial narratives that reinforce stability and growth potential

4. Transition Phase: Aligning Profit with Exit Strategy

Whether the goal is sale, succession, or gradual withdrawal, financial presentation during this phase is pivotal to achieving desired outcomes.

Capital & Exit Landscape:

Transition pathways may include:

1. Third-party sale

2. Family succession

3. Management buyout or employee stock ownership plan (ESOP)

4. Partial step-back with retained equity

Each scenario carries distinct tax and valuation implications.

Profit vs. Tax Considerations:

For outright sales, maximizing reported profitability enhances enterprise value; buyers focus intently on EBITDA, cash flow, and return metrics

In cases of succession with retained equity, minimizing tax liability while ensuring sustainable income often takes precedence

Legacy transitions may benefit more from steady cash flow than from isolated profit spikes

Strategic Guidance:

Initiate transition planning 3–5 years in advance to align financials with the intended exit

Recast financial statements to accurately reflect operational performance and strategic value

Engage valuation professionals to ensure alignment between financial positioning and exit objectives

Final Considerations: Profit as a Strategic Capital Signal

Profit is not merely a reflection of operational success. It is a critical signal to lenders, investors, successors, and other stakeholders. Effective profit planning aligns tax strategy with growth ambitions, capital needs, and eventual exit goals.

At The Morpheus Consultancy, we guide business owners through these decisions—ensuring that their financial statements support, rather than constrain, future opportunities. Whether you are seeking growth capital, planning for succession, or refining your tax approach, we can help you structure a path that aligns financial management with long-term objectives.

Let’s start a conversation. Because your profit and loss statement should serve as a tool for strategy—not just a snapshot of history.